GOLD SETS THE STAGE FOR A TRULY GOLDEN RETIREMENT.

In today’s uncertain economy, some experts suggest a smart way to protect your savings and retirement money is by adding gold and other precious metals to your investments. Here’s why it’s a good idea:

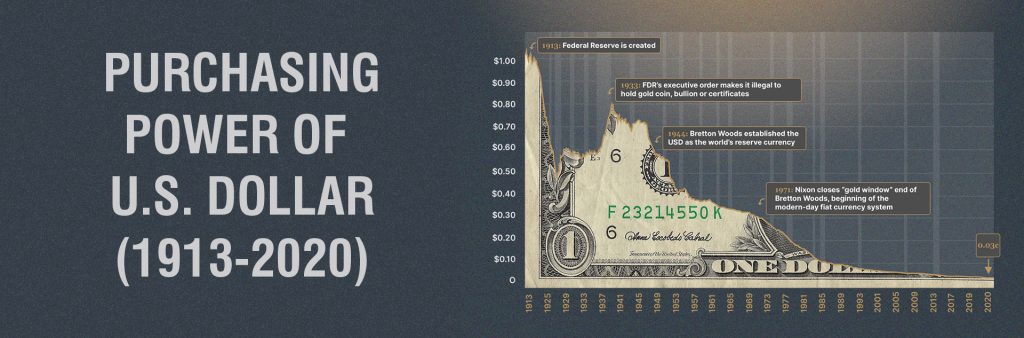

• Gold’s price has gone up a lot in the 21st century, while the value of the dollar has gone down.

• When prices are rising a lot (inflation), regular money can lose value, but precious metals like gold tend to keep their worth.

• People often think of gold as a way to keep their money safe when prices are going up a lot.

• Precious metals, like gold, are valuable everywhere in the world, making them like a universal currency.

• Having some precious metals can help protect your money during tough economic times and when governments are making a lot of new money.

• People have liked precious metals for a long time because they’re rare and beautiful, and that hasn’t changed.

Value over five decades? While it’s unlikely that gold will maintain that rapid pace of appreciation in the next fifty years, what makes gold appealing is its historical track record of retaining value, even when other assets, economies, and nations face challenges. For many people, gold is seen as a stable and reliable asset. If you don’t already have some in your portfolio, it might be worth considering now.